34 min to read.

What is Cardano

What is Cardano used for? Is Cardano a good investment in 2024?

Table of Content

- What is Cardano ADA

- What is Cardano: an overview of the project and its development

- How to buy and store ADA cryptocurrency

- Pros and cons of different wallets

- How to make money with Cardano: 4 best ways

- Cardano faucets

- Trading on crypto exchanges

- Investment

- Staking Cardano

- Cardano project team

- How the Cardano blockchain works?

- ADA Cryptocurrency Tokenomics

- Cardano price forecast for today and 2022

- Advantages and disadvantages of Cardano

What is Cardano ADA?

Cardano is a Proof-of-Stake blockchain platform built in the Haskell programming language by Ethereum co-founder Charles Hoskinson and his colleague Jeremy Wood. Officially launched on September 29, 2017. It is named after the outstanding 16th-century scientist Geloramo Cardano, and its own cryptocurrency ADA (₳) is named after Ada Lovelace, who created the first computer program in the 19th century. Cardano supports the creation of smart contracts and tokens, making it a direct competitor (“killer”) of Ethereum.

Ada is a digital currency. Any user, located anywhere in the world, can use ada as a secure exchange of value – without requiring a third party to mediate the exchange. Every transaction is permanently, securely, and transparently recorded on the Cardano blockchain.

What is Cardano: an overview of the project and its development

Development began in 2015, a few months after the founders left Ethereum. The main distinguishing feature of the Cardano project from the very start is a rigorous scientific approach to development: all innovations are reviewed and verified by the scientific community. This allows the blockchain to remain reliable and stable, as well as avoid vulnerabilities and flaws in advance.

Also, today Cardano is the largest blockchain with an “environmentally friendly” Proof-of-Stake algorithm, where the energy costs for staking compared to mining are 99% lower. However, this title will be lost after the transition of Ethereum to PoS. Initially, the project was funded through an ICO; in 2015-2017, several rounds of public cryptocurrency sales took place at once. Japan became the main target country, so far there are two official languages on the project sites - English and Japanese. The sale price of the cryptocurrency was only $0.02, but the developers managed to raise $60 million. Cryptocurrency ADA entered the exchanges in October 2017 and in 3 months has risen in price by 50 times - up to $1. True, after that, the price collapsed by 90% following Bitcoin (its price fell from $20,000 to $3,000), but in 2021, the price of ADA set new records and reached $3. Cardano is developing according to a pre-approved roadmap , calculated until about 2025.

It is divided into five major stages:

- Byron — blockchain creation, development of key ecosystem components (ADA cryptocurrency, Ouroboros protocol, Daedalus wallet), community creation and growth.

- Shelley is a period of decentralization through the introduction of ADA staking.

- Gauguin - expanding the functionality by adding smart contracts, supporting decentralized applications and a variety of tokens (including NFT).

- Basho is a period of optimization and improvement of the scalability of the Cardano network. Sidechains will be introduced, which will take over part of the load and make it possible to test updates more safely.

- Voltaire - the introduction of direct democracy and a voting system: network members will be able to use cryptocurrency to support community projects and independently determine the future of the blockchain.

The ultimate goal of Cardano is to create an independent decentralized system that will be self-sustaining, able to develop on its own and solve community problems. It looks ambitious, but so far the project has kept its promises, although not too fast compared to competitors. In 2022, the project is at the Gauguin stage: smart contracts have already been added, support for decentralized applications is expected to be implemented. In parallel, work began on improvements from the Basho era. While there are still many challenges ahead for developers, the Ethereum community already sees Cardano as one of its top competitors, judging by Vitalik Buterin's Twitter vote

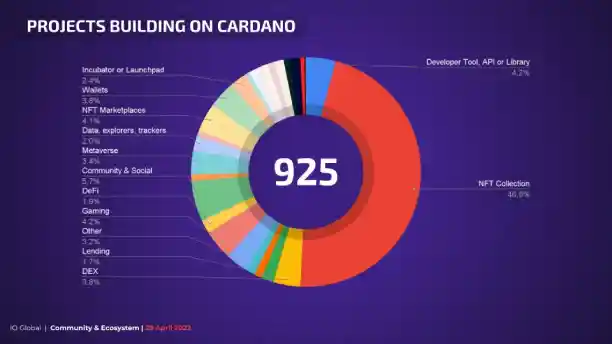

This is not surprising - the Cardano ecosystem is developing rapidly, it already includes dozens of projects in various areas of the crypto market, and every year their number is growing:

In addition to participating in the blockchain industry, Cardano has interesting partnerships with governments, academic institutions, and real businesses:

- The government of Georgia - the reform of the education system, the development of public services on the blockchain, several business projects.

- Ethiopian government (in the future, cooperation with other African countries) - state digital currencies, personal identification systems, microfinance.

- Universities of Greece — verification of diplomas on the blockchain.

- New Balance (shoe brand) - product authentication system.

There are also partnership prospects in healthcare, agriculture, logistics and other areas where blockchain technology can be useful for verifying something or ADA cryptocurrency as a payment and financing method.

How to buy and store ADA cryptocurrency

The low cost makes the ADA cryptocurrency an attractive digital asset for purchase also from the point of view of psychology - its price fluctuates around $1 and this is quite convenient. There are many ways to become an owner of cryptocurrencies , but when it comes to Cardano specifically, the most profitable way to do it is through these services:In principle, these two methods are quite enough - a crypto-exchange allows you to make a purchase as profitably as possible, and exchangers make it possible to transfer virtually any electronic currency to ADA. Commissions in the Cardano network are not very high on average, so after the purchase, you can send the cryptocurrency to any external wallet of your choice or leave it on the exchange account.

There are not many crypto wallets that support Cardano, but the variety is enough for any purpose:

Binance

Trustee Wallet

Ledger

Daedalus

Pros and cons of different wallets:

- Binance is a convenient option for storing cryptocurrencies due to the great opportunities for exchange and earnings (Binance offers good staking conditions and the ability to trade pairs with ADA). Cons: exchanges are constantly attacked by hackers, the wallet is not 100% controlled by you, identity verification is required.

- Ledger is the most reliable option, the so-called "cold" wallet without the need for constant access to the Internet, such a wallet is almost impossible to hack. It is a device in the form of a flash drive and costs $100-200 depending on the model.

- Trustee is one of several mobile apps that support Cardano. It has good security: you can set up fingerprint or face recognition login, the company does not store user keys, the source code is in the public domain.

- Daedalus is the official Cardano wallet for PC with a high level of security, which allows you to earn on staking and participate in the life of the project. Other cryptocurrencies are not supported. To work, you will have to download the blockchain and constantly synchronize.

It is difficult to say which of the wallets will suit you personally - try all the options. Most importantly, keep your private keys and recovery phrases in a safe place and do not show them to anyone.

How to make money with Cardano: 4 best ways

You can not only keep cryptocurrency on your wallet, but also make money on it. ADA cryptocurrency is consistently among the top ten most popular digital assets and there are enough ways to earn income with it.

Cardano faucets

As always, it is possible to receive a small amount of cryptocurrency without investment on special faucet sites. There are several options, the simplest is to enter the site after a certain time and click the special “win” button. Cryptocurrency ADA in faucets is not common, here are the sites that I know about:

freecardano

Coinfaucet

Coinpayz

coinpot

Trading on crypto exchanges

The way to earn money with the highest income potential and the highest risks. By making transactions on the exchange with leverage, you can increase your investments several times - but if you make a gross mistake, there is a chance to lose all your money. However, this is the most popular way to make money with cryptocurrencies, and you can use it with Cardano too. Here are some exchanges where it is profitable to trade ADA:

Binance

FTX

Huobi Global

Bitfinex

OKX

Bybit

In order to make money on trading, you need to go through training and find a suitable trading system. Without experience and skills, it’s better not to get into it - you will only lose money faster. The profitability of your transactions should be at least a couple of times higher than the profitability of Bitcoin - otherwise it is better to choose a regular investment.

Investment

Cryptocurrency Cardano has been among the leaders in the capitalization rating of blockchain projects for several years. Despite its shortcomings, it is one of the most promising Ethereum competitors.

ADA can be considered for a long-term buy-and-hold investment : it has a solid foundation in the form of an experienced development team and Twitter with a rapidly growing number of followers (already over a million). It was also very important to introduce support for smart contracts and decentralized applications - this will allow the project to occupy a niche in various sectors of the crypto market.

In terms of profitability, Cardano outperforms Bitcoin, although not by much:

Staking Cardano

Staking Cardano is a passive income option by participating in maintaining the operation of cryptocurrency networks with the Proof-of-Stake consensus algorithm, similar to mining. The difference is that for staking you do not need to buy expensive equipment, you just need to purchase a cryptocurrency and block it in a wallet with the possibility of earning. There are two fundamentally different ways to stake cryptocurrency:

- Create your own node, that is, a node of the cryptocurrency network that checks and approves transactions,

- Delegate cryptocurrency to the staking pool.

An easier way to make money, obviously, is the second one - you just need to entrust the cryptocurrency to another owner of the node. Of course, he will not be able to appropriate the money, only use it for staking. The profitability potential will be lower than with your own node, but there will be no strain. One of the best Cardano staking options is through the Binance exchange:

| Binance Ada Coin Stake Rates (Data Date: 31.05.2022) Check Binance for the live rates | |||

|---|---|---|---|

| ADA | Locked Staking | 11.23% | 90 Days |

| ADA | Locked Staking | 8.24% | 60 Days |

| ADA | Locked Staking | 7.75% | 30 Days |

| ADA | Flexible Savings | 1.00% |

Flexible |

Cardano project team

Three companies are involved in the development, management and promotion of Cardano:

- The Cardano Foundation is a Swiss non-profit organization that owns the rights to use the Cardano brand. He is engaged in the promotion of the blockchain, relations with regulators, companies and the public.

- Input Output Hong Kong (IOHK) is one of the leading blockchain infrastructure research and development companies.

- Emurgo is a global investment fund with offices in America and Asia that invests in crypto startups and helps clients integrate into the Cardano ecosystem.

The companies are unrelated in terms of owners and actively cooperate. Since 2015, the IOHK company has been developing and improving the technical characteristics of the Cardano blockchain, which is represented by the following individuals:

- Charles Hoskinson is a software developer and entrepreneur, founder and director of Cardano. He was educated at the Universities of Denver and Boulder (USA). Also known as the co-founder of Ethereum, left in 2014 due to disagreements with Vitalik Buterin over blockchain monetization. In 2015, he founded IOHK, whose key product is Cardano. The main media face of the project.

- Jeremy Wood is a mathematician and businessman, director of strategy for the development of the Cardano project. In 2015, together with Hoskinson, he founded IOHK. He studied at Indiana-Purdue University in Indianapolis, after which he lived in Japan for several years, where he first learned about cryptocurrencies. Before Cardano, he worked with Hoskinson at Ethereum, until 2014 he was the Executive Director of the Ethereum Foundation. Advised several other cryptocurrency projects.

- Aggelos Kiayas is a cryptographer and computer scientist and Chief Scientist at IOHK. Head of the Department of Cybersecurity and Professor at the University of Edinburgh. He joined IOHK in 2017 and became the Director of the Blockchain Technology Development Lab. He has received a large number of awards for his research in cryptography, has dozens of publications in scientific journals and speeches at conferences.

- Romain Pellerin is the Chief Technology Officer of IOHK. He received his PhD in distributed computing from the National Conservatory of Arts and Crafts (one of the most prestigious educational institutions in France). Since 2017, he has been creating blockchain-based open source products and projects with a focus on lowering the barrier to entry into the industry for businesses. Joined IOHK in 2020.

In total, the IOHK team has more than 300 people , among which there are many experienced workers in the blockchain industry, as well as doctors of sciences and professors. If you add the people working on the project at Cardano Foundation and Emurgo, you get a large and experienced team that can make a world-class project.

How the Cardano blockchain works

Cardano is considered a third-generation blockchain (first and second - Bitcoin and Ethereum), which took the best ideas of its predecessors and tried to solve their main problems.

Problem #1: Scaling. The Bitcoin network cannot process more than 10 transactions per second (for comparison, the speed of VISA is several thousand per second). If the transaction flow exceeds this value, a queue arises - some applications wait to be added to the blockchain for hours, and some are completely rejected. To speed up the process, you can increase the fee, but this does not solve the problem, and the average price of sending BTC grows to $50 and above:

Several innovations have been introduced to Cardano to scale, such as the use of the Proof-of-Stake consensus algorithm. If you are unfamiliar with the term PoS, I recommend additionally reading the basic guide to cryptocurrencies . In short, this is a way to maintain the network through staking, where the owners of the network nodes block the ADA cryptocurrency in their wallets and receive a reward for this. The need for mining is eliminated and this saves both energy and computing resources.

The developers of Cardano were among the first to put into practice a unique PoS algorithm called Ouroboros . Its main goal is to speed up the blockchain in parallel with the growth of the number of users in order to avoid delays and high fees. To do this, in Ouroboros, the blockchain is distributed into epochs (periods of 5 days each):

Cardano blockchain explorer lates epochs

Further, the epochs are divided into even smaller time slots of 1 second each (432000 in one epoch). Such a system allows you to flexibly configure the blockchain parameters - time intervals can be changed and thereby speed up or slow down the network.

Each slot has a leader that is chosen randomly among all ADA cryptocurrency stakers, larger players have a higher chance of creating a block:

The slot leader is responsible for adding a new transaction block to the blockchain and passing the baton to the next leader. To protect the protocol, “approval delay” is used - the last few blocks are considered temporary and only after verification by several leaders receive confirmation. Transaction fees are collected during an epoch and distributed at the end of the epoch to leaders who added blocks.

The second important innovation is the division of the blockchain into two layers. The first is called the Cardano Settlenemt Layer (CSL), which is essentially a ledger that only records cryptocurrency transactions. The second layer is the Caradno Computation Layer (CCL), where smart contracts of any complexity are launched. This separation allows the network to withstand higher loads and scale better.

Problem #2: Interoperability – in other words, the ability to “collaborate” with other blockchains. Imagine if the dollar could not be spent outside the US - would it be useful? Yes, but much less than when it can be sent anywhere in the world and exchanged for local currency . The same problem with cryptocurrencies - they only allow transfers within their network, but if it becomes possible to send money directly to other blockchains, this will be a definite plus.

Cardano is working on this issue and plans to implement bridging support :

Bridges are decentralized applications with the ability to move assets between different blockchains. Specifically in Cardano, support for KMZ sidechains will be added. One of the most anticipated projects is the Ethereum-Cardano bridge, which looks especially interesting given the rivalry between these projects.

Problem #3: Sustainability. For the long-term development of the blockchain and the growth of its capitalization, guarantees are needed that it will be available 100% of the time - this is solved through decentralization and reliable code. It is also important that there are developers who will continue to improve the blockchain in the future. Cardano will solve this problem by introducing a "treasury" - it is replenished from transaction fees. In the future, community projects will be funded from the treasury, for which it will be possible to vote with cryptocurrency. At the time of writing, it has reached hundreds of millions of ADA:

As you already know, the voting system and elements of democracy will be introduced later, so for now, the treasury is just accumulating at a rate of several million ADA per era.

In principle, today Cardano's approach to the development of the system is no longer unique - dozens of projects are trying to solve the three main problems of cryptocurrencies, including Bitcoin and Ethereum. However, few projects can boast of stable work for a long time and a clear development roadmap that is gradually being implemented.

ADA Cryptocurrency Tokenomics

Before making any Cardano price predictions, it is important to understand the economics of the cryptocurrency (tokenomics). Each blockchain project has its own token distribution policy, in Cardano it is well decentralized: the community owns more than 80% of ADA, so the project management cannot have a serious impact on prices:

Unlike Ethereum, the maximum amount of ADA is limited, which makes the currency deflationary in the long term, like Bitcoin. In total, 45 billion units of currency will be issued, of which 34 billion or 75% have already been mined:

For comparison, the maximum amount of BTC is 21 million, 2000 times less than ADA. This is the reason for the low price of Cardano - the total capitalization is divided into a larger number of tokens. Therefore, even $10 for ADA is an extremely optimistic forecast, although in 5-10 years such a scenario may become a reality.

The distribution of new coins occurs in the form of a reward for staking. The absolute increase in the number of coins in the network for 2021 was 7.63% or 2.38 billion ADA:

The amount of ADA mined will gradually decrease each year (the method is similar to Bitcoin - mining staking rewards will become lower in the future). If we assume that 1% of the cryptocurrency supply is lost every year due to errors, then by about 2031, ADA will become a deflationary coin:

Up to this point, of course, there is still a long time, but the main idea is that the further, the less new ADA appears on the network. A decrease in supply will make the coin more valuable and will lead to additional growth in value in the long run.

Cardano price forecast for today and 2022

If you are thinking about purchasing Cardano cryptocurrency for storage and / or earnings, you should first study the current market situation and the forecast for 2022. I usually start with technical analysis - the study of price charts and mathematical indicators that help in predicting price movements. If you have experience in stock trading, then you can do it yourself without any problems, otherwise you can use this tool:

The graph speaks for itself: if the arrow is in the “buy” zone, then the market has a good opportunity to buy cryptocurrency. Well, if a sell signal is shown, it is better to wait for a better moment. Of course, you can try to short (bet on a fall) cryptocurrencies, but this is not very profitable and very risky: the maximum profit is small, and losing a deposit during the explosive growth of the crypto market is a piece of cake.

After studying the findings of technical analysis, it is worth taking a look at how expensive the ADA cryptocurrency looks compared to Bitcoin, for which we look at the ADABTC ratio :

Usually promising altcoins (which include Cardano) overtake Bitcoin in terms of profitability in the long run. So the default strategy looks like this:

- if the ADABTC rate is close to the historical maximum, purchases should be made very carefully - there is a possibility that the price is already too high and a rollback will occur;

- if the ADABTC rate is noticeably lower than the highs, prices may be close to the bottom of the drawdown, which means that buying looks more attractive.

And finally, I look at how often cryptocurrency is mentioned in the media. This is one of the main factors that affect the price: the more people talk about Cardano, the more people buy cryptocurrency. In general, it’s not the number of mentions that matters, but the dynamics — so the Google Trends tool fits perfectly:

If the frequency of Cardano mentions is growing rapidly (and especially if it is close to the maximum) - this has a favorable effect on prices, there will be more people who want to buy cryptocurrency. Usually this one does not last long, so it is better to take profits if possible. If the values are falling and generally quite low, the price has pulled back and may be close to a minimum, which provides good buying opportunities.

As for the longer-term forecast for 2022, Cardano still has good prospects thanks to the latest technical updates. Support for smart contracts was implemented in 2021, and a platform for creating decentralized applications will appear in 2022. Next, the developers are going to work on the speed and scaling of the blockchain. In general, the project has already begun to play on the Ethereum field and while the latter solves scaling problems, there is time to increase market share in the hottest DeFi, GameFi and NFT sectors - which will increase the demand for ADA.

Advantages and disadvantages of Cardano

Today we examined the patient from various angles, we got quite a lot of information. To summarize the above, I have highlighted the pros and cons of the Cardano blockchain and made a final opinion about the project.

Advantages of Ada Coin:

- Development team — hundreds of people are working on blockchain improvements, including experienced crypto industry figures, mathematicians and cryptographers;

- Scientific approach - every innovation in Cardano is discussed and verified many times by the scientific community;

- Social networks - Twitter has more than a million subscribers, one of the largest cryptocurrency communities;

- Development plan - the project roadmap is scheduled for several years ahead and is being observed so far;

- Low commissions - at the moment, ten times lower than in Ethereum;

- Support for smart contracts is the most important factor in the growth of blockchain capitalization today.

Disdvantages of Ada Coin:

- Slow development - compared to competitors, Cardano is not growing fast enough, for example, Solana caught up in capitalization in a year;

- Tough competition – dozens of promising projects are fighting for a share in the crypto market, including several “Ethereum killers”;

- Low prevalence - compared to BTC and ETH, there are much fewer ways to buy and sell.

Frequently Asked Questions

How is Cardano different from Bitcoin?

The difference between Cardano and Bitcoin is that Cardano is the first blockchain to be evaluated by the pair in the cryptocurrency space. To examine them thoroughly, Cardano organized a team of researchers from many prestigious universities and other experts. Bitcoin is an unknown individual or group named Satoshi Nakamoto, developed in 2008. Cardano is one of the largest cryptocurrencies by market cap. The concept of Ethereum is to develop the next generation blockchain, a flexible, durable and scalable smart contract platform that allows the creation of various decentralized financial applications, new crypto tokens, games and more. Bitcoin was established as a digital currency in January 2009. The idea of the mysterious pseudonym Satoshi Nakamoto was published in a white paper. The name of the person who invented this technology remains a mystery. Bitcoin promises lower transaction fees than standard online payment channels and is governed by a decentralized authority, unlike the currency issued by the state. Cardano is a type of Ethereum, while Bitcoin is a type of cryptocurrency. Cardona was developed by Charles Hoskinson, while Bitcoin was developed by Satoshi Nakamoto. Cardano is a type of Ethereum, while Bitcoin is a type of cryptocurrency. Cardona is fast and Bitcoin is slow. Cardona was founded in 2017, while Bitcoin was founded in 2009.

Is Cardano a good investment?

While the current momentum is bearish for Cardano as well as most major cryptocurrencies, ADA could be a good long-term investment.

Is Cardano better than Ethereum?

There is a lot of information to sift through when comparing Cardano and Ethereum. While Cardano has many features that excite technologists, Ethereum may still be the best choice for smart contract, DeFi, and dApp development. However, this does not mean that Ethereum will always be the best choice. Cardano’s academic approach has already yielded good initial results, and it is important to focus on what the Cardano blockchain will do in the future. I hope Cardano is right. Ethereum makes more sense to you now, but if you have any questions, please contact an application development partner for guidance and advice on all things blockchain.

Are cardano coins limited

Yes cardano coins are limited. The circulating supply is 33,739,028,516 ADA coins and is at its maximum. 45,000,000,000 ADA coins.

Are cardano fees high

The size of the commission directly depends on the supply and demand in the market at the time of the transaction. On average, this parameter is 0.16-0.17 ADA. Also, the amount of the fee may vary with changes in electricity costs, equipment capacity and competition within the network. Cardano is designed so that the system of transaction fees covers the costs of processing and long-term storage. The uniqueness of the network lies in the fact that the fees received are not sent directly to the block producer. First, the funds are collected in a single pool, after which they are distributed among the staking participants.

Are cardano smart contracts live

Smart contracts are an analogue of a legally binding agreement, which is translated into a programmable digital environment, it is stored on a decentralized blockchain. Due to the lack of access to information in the block for third parties, no one can undermine the contract with their actions. Individuals or companies cannot influence smart contracts. The prescribed action in the system is carried out only after confirmation of the fulfillment of certain conditions by each of the parties to the transaction. Cardano itself is the first 3rd generation blockchain. When creating it, the developers focused on scalability, stability and compatibility with other projects both within the network and beyond. All this led to the formation of a number of distinctive features that allow maximizing the level of development, improving the security of the protocol, etc.

Can cardano be mined

No, cardano can not be mined. Direct mining of coins does not exist, because. the Proof of Work consensus was not taken as a basis. The only way to receive cryptocurrency is to store it in the Daedalus wallet, which is the main one for ADA. In return, the user receives rewards in the form of the same coins. This is how the Proof of Stake consensus works, allowing you to earn money by confirming transactions, not by providing hardware.

Can cardano be staked

Yes cardano can be staked. Staking is one of the ways to earn cryptocurrencies. To do this, you will need to invest assets, after which the user will receive a reward as a percentage. The rate is determined for each stake pool individually, but on average it is 5% per annum. You can choose a suitable deposit using the Daedalus wallet from Cardano, where a delegation screen is provided in the Stake Pools section. The PoolTool and Adapools websites are used to track the status of each stake, they allow you to get information about the quality of the services provided.

Can cardano be staked on coinbase

Yes, cardano can be staked on coinbase. You can begin earning rewards on your crypto. The current estimated annual return for Cardano staking on Coinbase is ~3.75% APY. Once your initial holding period completes (20–25 days), you’ll receive rewards in your account every 5–7 days.

Can you buy cardano with cash

Yes, you can buy cardano in cash.

Can you buy cardano with credit card

Yes, you can buy cardano with credit card in exchanges that supports credit card as a payment method for example; binance, coinbase etc.

Does cardano burn coins

No, Cardano does not burn coins according to Charles Hoskinson.

is ada and cardano the same thing

Yes, ada is the short form of Cardano like Bitcoin - BTC.

is cardano an erc20 token

No, Cardano is not an erc20 token. Some popular erc20 tokens are Text Chainlink (LINK) Tether (USDT) Shiba Inu (SHIB) Wrapped Bitcoin (WBTC) OmiseGO (OMG) 0x (ZRX) Text Maker (MKR) Augur (REP) Golem (GNT) Loopring (LRC) Basic Attention Token (BAT)

is cardano an ethereum killer

Yes, Cardano is know as an ethereum killer.Today, smart contracts will be implemented in Cardano. This is certainly a milestone that will determine whether the project will be successful on a larger scale in practice. Since both Cardano and Ethereum are undergoing significant changes, it is difficult to say which one will turn out better. Cardano may come close to Ethereum in terms of market capitalization, but future events will determine whether it is hailed as the killer of Ethereum.

How to buy ADA in 4 steps

How to buy ada

Estimated Cost

$0

Estimated Total Time

5 min

What is necessary:

ID Card

E Mail

Phone Number

Payment Method

Tool: A cryptocurrency market.

Compare Cryptocurrency Markets

Find an exchange that lists ADA in one or more cryptocurrency pairings. Then sign up with your email address and password. Compare exchanges when buying ADA to find the lowest fees and the latest exchange rates. Note: Many exchanges require your full name, contact information, and ID before allowing you to trade.

Create an account

To create an account with an exchange, you must verify your email address and identity. Have your photo ID and phone ready.

Make Payment

If your exchange supports Cardano, you can buy ada directly with dollar, euro, pound or any other currency of your choice. Some exchanges charge commission fees that vary depending on the amount of ADA you buy, so be mindful of the cost of your transaction. Note: Some payment methods have higher fees and credit card payments are usually the most expensive.

ada buy

Select your chosen exchange to find the ADA match you want. Go to the markets section. Look at the buy ADA section and type in the amount of paired cryptocurrency you want to spend or the amount of ADA you want to buy. Note: Before completing the transaction, carefully review your transaction details, including the amount of Cardano you purchased and the total cost of the purchase.

Where to buy Cardano

| Binance | WhiteBIT |

| KuCoin | Deepcoin |

| Huobi Global | BitMart |

| Gate.io | XT.COM |

| Binance.US | Dex-Trade |

| Kraken | CoinEx |

| Bybit | ExMarkets |

| Bittrex | AAX |

| Poloniex | BtcTurk | Pro |

| OKX | WOO Network |

| ZB.COM | CoinDCX |

| Crypto.com Exchange | Bitbns |

| Phemex | KickEX |

| BitGlobal | Paribu |

| AscendEX (Bitmax) | EXMO |

| LBank | Bitexen |

| MEXC | Giottus |

| Tokocrypto | MAX Exchange |

| WazirX | MDEX(BSC) |

| Bitrue | CEX.IO |