34 min to read.

What is cryptocurrency

What is cryptocurrency and how does it work? Is crypto real money? How does cryptocurrency make money?

What is cryptocurrency and how it works: a detailed beginner's guide

If you are at least a little interested in modern technologies, you could not pass by cryptocurrencies, which in recent years have made a lot of noise in the media and helped to replenish the Forbes list with several billionaires. New digital money arose suddenly and literally out of the blue turned into a very promising way to earn and invest, capable of bringing incredible profits. For example, the most popular cryptocurrency Bitcoin just a few years ago, in 2017, brought investors 1331% profit. And today there are already several thousand digital coins and every day there are more and more.

What are cryptocurrencies? In fact, this is just another modern technology that can be mastered, as you are already accustomed to bank cards and smartphones. In this article, I have collected answers to the most important questions on cryptocurrencies and tried to explain everything in an accessible way for beginners.

What is cryptocurrency in simple words

The prefix of crypto comes from the science of cryptography, which studies methods of protecting and encrypting valuable information.

Cryptocurrency is a type of electronic money, which is characterized by the absence of a single center. The work of the cryptocurrency payment system is supported in parallel by thousands of computers around the world (for a fee), and money transfers are processed completely automatically.

The first attempts to create currencies that are not an electronic copy of dollars or other real currencies were back in the 90s of the last century. Unfortunately, then electronic payments were not so common, and the speed of the Internet was much lower, so that the prototypes of cryptocurrencies could not become successful and stimulate developers to further develop this technology.

As a result, only in 2009, a certain Satoshi Nakamoto (it is not known whether such a person really exists or this is the pseudonym of a group of developers) created the first cryptocurrency Bitcoin. This news went completely unnoticed by the world, and one of the oldest transactions subsequently became a meme:

Programmer László Heinitz bought two pizzas in 2010 for 10,000 bitcoins (today it is several hundred million dollars!). Now May 22 is celebrated as Bitcoin Pizza Day.

As a payment method, cryptocurrency is no different from any other electronic currency – similarly, there is a list of people and everyone has a certain amount of money in the account:

A terrible combination of numbers and letters is just a wallet address, the usual analogue is a 16-digit bank card number. To send money to someone, you need to specify this address and the number of coins:

In this case, the operation is irreversible! Each transfer is saved and cannot be canceled. For this reason, you need to check the correctness of the wallet three times, it is best to add it through Ctrl + C and Ctrl + V. It is also important to choose the right network for sending - so that the recipient can accept the cryptocurrency in the way you specified.

Bitcoin and the vast majority of cryptocurrencies are not tied to real assets like the US dollar. This means that their price changes only according to the economic laws of demand (how many people want to buy) and supply (how many cryptocurrencies are in the system). However, there are so-called stablecoins that fully correspond to the US dollar, gold or other asset. They are very popular because they are a real competitor to international payment systems like SWIFT.

In the screenshot above, you saw that some wallets contain billions of dollars in virtual currency! How can you trust so much money to a system that can't even be touched? Well, crypt has its advantages:

Decentralization – the cryptocurrency network does not belong to one state, company or individual, which excludes the possibility of unilaterally changing the rules of the game, "printing" cryptocurrency in any quantities or suddenly closing the project. The network is constantly supported by a large number of computers, and for any changes in the code, an agreement between developers and users on a democratic principle is needed.

Speed – the transfer of currency to another country can take several days, cryptocurrencies reduce this time to a maximum of 60 minutes, modern networks like Solana cope in a minute.

Anonymity – wallet numbers consist of random combinations of symbols, and all cryptocurrency transactions are in the public domain. True, sometimes it is still possible to connect the owner of the wallet with a specific person, if he somewhere "shines" his address.

Low fees - for example, the transfer of $ 500,000 in the Bitcoin network can cost only $ 10 or even lower, depending on the network load.

High reliability - in cryptocurrencies it is almost impossible to forge transactions thanks to the "blockchain" technology (I will talk about it in more detail later).

Investment prospects – at the beginning of the article I gave you an example of Bitcoin profitability, and this is very attractive for investors, despite the possible risks. Plus, to invest in cryptocurrencies, you do not need to send a bunch of documents, you can even do it completely anonymously.

Of course, there are drawbacks

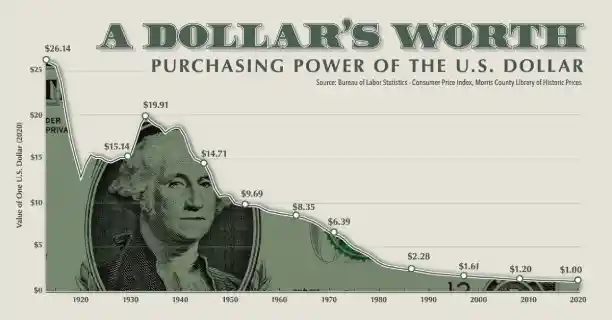

Volatility – cryptocurrency prices are unstable and can change by tens of percent both up and down. In 2018, the last major price collapse occurred: Bitcoin sank by 75%, and with it other cryptocurrencies. However, after 3 years it grew by several hundred percent... In general, there is no stable growth and reliability in cryptocurrencies.

Problems with legalization - laws on the use of cryptocurrencies are still at the development stage, and in some countries they are banned. Read more in the section of the article "Legality of cryptocurrencies".

The possibility of complete loss of access - in case of loss of the password from the wallet and special seed-words, it is impossible to return access to the cryptocurrency. For example, there is a story how a resident of Wales, James Howls, threw away a hard drive with a password and then spent years trying to find money to hire equipment to search at a local landfill. Apparently, the happy ending did not happen.

In general, cryptocurrencies look like a promising technology, especially if you delve deeper into the mechanism of its work.

How Cryptocurrency Works

I will try to explain as accessible as possible, without diving into technical details and complex mathematics. So, all transactions in cryptocurrency are in a single database, which is called the "blockchain":

Blockchain is a serial chain of blocks with information, built according to special rules and protected by cryptographic methods. In cryptocurrencies, the technology is used to protect transaction history from changes and confirm the authenticity of new transfers.

Each block of the cryptocurrency blockchain stores information about several transactions: the addresses of senders and recipients, the amount of the transfer, the time of transfer, and so on. Next, the blocks are linked in chronological order using a so-called hash function. If we simplify, then its main essence is that when you try to imperceptibly change the data "retroactively", the entire blockchain changes and the hacking attempt is visible immediately.

Blockchain does not depend on a particular person and organization – its copies are stored on the computers of thousands of users (they are called nodes) and synchronized at a certain interval. In other words, each participant in the network is the carrier of the blockchain and it is impossible to destroy it without destroying the Internet as a whole (and then, it will be stored on hard drives). However, how to make sure that all transactions are real and there are no scammers among users?

To do this, consensus algorithms are used - special rules for adding new blocks, in which nodes from all over the world participate. To put it as simply as possible, thousands of computers around the world "vote" for new blocs and reach that very consensus democratically. As long as no user has access to most computers on the network, voting will always win the right block – this makes it easy to weed out attempts to interfere with the blockchain.

There are two popular consensus algorithms – Proof-of-Work and Proof-of-Stake:

The difference between the two is how a computer is chosen to make changes to the blockchain (for which it receives a reward). The PoW algorithm first appeared in Bitcoin and is known to each of you for mining:

Mining (from the English mining - mining) forces users' computers to solve a complex mathematical problem, which takes some time, depending on computing power. Who finds a solution in the allotted time, gets a chance to add a new block and earn a reward (in Bitcoin 6.25 BTC).

Today in the world, mining consumes energy, which is enough for a whole country like Argentina. For this reason, the PoS algorithm and staking are gaining popularity:

Staking is an alternative to mining, in which the right to add a block is given to users with a cryptocurrency blocked in the wallet. The probability depends on the size of this amount, and the profit on average is several% per annum. It resembles bank deposits, only in cryptocurrency.

10 most famous cryptocurrencies

In total, there are several thousand different cryptocurrencies, the times when there was one Bitcoin are long gone. Their total value (capitalization) reaches $ 2 trillion - about the same as Apple. Of course, you do not need to study them all, it is enough for beginners to know about the most popular:

- Bitcoin (BTC) is the first and most famous cryptocurrency. It spawned a new financial industry and created the ideological basis for thousands of other digital coins. Despite the presence of technical better-implemented projects, bitcoin is known all over the world as a symbol of the crypto market. If cryptocurrencies are accepted somewhere, there will definitely be bitcoin, and only then the rest of the coins. Bitcoin is the most expensive cryptocurrency on the market and occupies half of the market.

- Ethereum (ETH) is the second most popular cryptocurrency in the world. In Ethereum, for the first time with the use of blockchain, smart contracts were implemented (programs that allow you to automatically execute agreements between several parties on the Internet). Also on the basics of the Ethereum platform, you can launch other cryptocurrencies using the ERC-20 standard. Of these, 40 are in the top 100 by capitalization, for example, Tether (USDT) is the main stablecoin.

- Tether (USDT) has become the most used stablecoin, that is, a cryptocurrency with a stable value. Its price reflects the price of the US dollar in the ratio of 1: 1. The peg to the dollar is provided by real securities, which are equal in value to the number of USDT in circulation (about 69 billion). Unlike the highly volatile prices of other cryptocurrencies, USDT is always roughly equal to $1, making it a convenient safe haven for crypto investors.

- Litecoin (LTC) is based on the Bitcoin protocol, but differs in some points: the block generation time is 4 times less (2.5 minutes instead of 10), transaction fees are also much lower. In general, the "light" version of Bitcoin, as well as the second most popular "pure" cryptocurrency. Good speed, ease of use and high profitability are a significant factor in competition with the "big brother" bitcoin, especially in developing countries.

- Cardano (ADA), unlike Bitcoin, uses Proof-of-Stake instead of Proof-of-Work. This means that the probability of creating a new block is proportional to the user's share in the cryptocurrency. This approach is considered less energy-intensive, Ethereum is also gradually moving to it. Before updates for the ADA, peer-reviewed studies are conducted, so they are based on reliable scientific data and allow you to foresee most of the negative consequences in advance.

- Binance Coin (BNB) belongs to the type of internal cryptocurrencies and helps in the work of the largest cryptocurrency exchange Binance. Its price is affected by both the general trend and the popularity of the exchange, since only BNB can be used for many operations. In addition, there is an automatic burning of 10% of the commissions in BNB: initially there were 200 million coins in circulation, and in the end there will be only 100 million and there will be no new ones.

- Ripple (XRP) is considered one of the fastest cryptocurrencies – operations take place in just a few seconds. This speed is achieved due to the lack of mining (all cryptocurrency is mined at the start of the project), instead of it, trusted translation validators with a consensus mechanism related to the task of Byzantine generals are used. The company Ripple is not only engaged in the cryptocurrency XRP, but also the platform for electronic payments RippleNet, where different coins are used.

Solana (SOL) also has a high speed, thanks to the Proof-of-History consensus algorithm. It checks with the help of cryptographic methods the reality of the transaction with reference to the time of its execution and this cannot be faked. This creates good scalability, which favorably distinguishes Solana from the same Bitcoin. Corporate clients became interested in the project, for whom the costs in international transfers are quite a sore subject due to commissions.- Dogecoin (DOGE) was originally a joke cryptocurrency based on the English-language Internet meme "doge". The coin branched off from Litecoin in 2013. Today, DOGE is in the top 20 popular cryptocurrencies not without the participation of Elon Musk, who has repeatedly written about Dogecoin on his Twitter. First of all, the coin is used as a tipping system on Reddit and Twitter as a reward for creating or distributing quality content.

- Polkadot (DOT) is distinguished by the ability to process many transactions (and in general any data) in parallel with the help of "parajan" (parallel blockchains), this allows you to increase the scalability of the network. The Polkadot project is associated with the creation of a new decentrali zed structure Web 3.0, the evolution of the Internet in order to remove outdated methods of managing the World Wide Web. The DOT cryptocurrency is used to conduct operations and maintain the operation of the parochen system.

Experts do not advise beginners to buy little-known cryptocurrencies, especially if they are advertised to you with any promises of profitability. With a high probability, this is a fraud or a financial pyramid under the guise of "modern technologies". For the first acquaintance with the head, Bitcoin and Ethereum are enough.

Purchase and storage of cryptocurrencies

Cryptocurrencies are gaining more and more popularity every year, there are many ways to buy them. Often, sites also support the ability to store cryptocurrency in your wallet – in the form of a balance on the account:

Often, there can be several cryptocurrencies in one wallet at once - for the convenience of users. They can be sent, received, and exchanged as needed. The interface on different sites and wallets differs in appearance, but there are no big differences in functions.

Here are some of the recommended ways to buy and store cryptocurrencies:

Cryptocurrency exchanges (for example, Binance) are trading platforms on which the purchase / sale / exchange of digital assets is carried out 24/7. They have the largest selection of cryptocurrencies and the lowest commissions. They can serve to store investments, but customers do not control private keys at 100% and there is always a risk of hacking the exchange (there were precedents).

Hot crypto wallets (for example, Trustee Wallet) are programs and applications that allow you to store dozens of cryptocurrencies in one place. Almost always allow you to buy crypto directly and exchange it. They have sufficient, although not ideal protection against hacking.

Cold crypto wallets (for example, Ledger) are special devices, usually in the form of USB flash drives. They cannot be used to buy cryptocurrency and they do not have constant access to the Internet, but the protection in them is such that it is virtually impossible to hack and steal money.

Online exchangers are sites where you can buy and exchange most existing electronic currencies and cryptocurrencies without identity verification. To use in advance you need to get a crypto wallet. Occasionally, there are scammer sites, so you must use monitoring sites (for example, ExchangeSumo) - they collect information on current exchange rates and real customers of exchangers.

P2P platforms (for example, Bitzlato) are sites where any user can create an ad for the purchase / sale of cryptocurrency and negotiate a price directly with other people, without intermediaries.

Payment systems (for example, AdvCash) are international transfer systems. Some of them began to support the purchase, exchange and storage of cryptocurrencies.

Instructions for beginners on buying cryptocurrencies in each of these ways you will find in the corresponding blog article. For the first acquaintance, an account on a crypto exchange is best suited - there are most different cryptocurrencies and opportunities for earnings, starting from $ 20. But even before the first purchase of cryptocurrency, it is extremely important to take care of its protection from scammers and hackers.

Protection of digital assets

Whatever type of wallet you use, when storing cryptocurrency, you need to ensure the maximum level of protection. Today, the situation in cybersecurity has become much better than in the first years of the crypt's existence, but still the protection of important data should be taken as seriously as possible.

Most likely, you will store cryptocurrency on one of the hot wallets. They can be divided into 2 types:

- A wallet service where you store money in the account of a company;

- A wallet application in which no one but you has access to money.

The first type of wallet is more convenient and easier to use – the company itself takes care of its creation and data protection. You need to ensure reliable protection of your account on the site - so that it is not hacked by choosing a password.

In addition to a complex password, it is important to connect all possible methods of additional protection. On the example of the binance crypto exchange wallet, you must immediately connect two-factor authentication or 2FA:

With 2FA turned on, you'll only be able to sign in to your account after confirmation from an alternate source: an additional security code comes to your phone, email, or through the Google Authenticator app. Of course, the mail should also be protected by a strong password, and the phone is locked to outsiders by a pattern, fingerprint, etc.

A withdrawal whitelist is a powerful tool to protect your cryptocurrency. When it is enabled, the attacker will not be able to withdraw money from the exchange to the address except for what you have specified in advance. Another way to access your information is to send emails purporting to be on behalf of the company. The anti-phishing code adds the set of characters you specified to this letter, which makes it possible to distinguish a real e-mail from a fake one.

The second type of wallets in the form of programs / applications is protected somewhat differently. Here you are 100% responsible for security and in case of hacking you will not be able to contact the company for compensation. The most important thing in crypto wallets is the seed phrase, which usually consists of 12 (sometimes) 24 words

This phrase is the direct access key to your wallet! It is difficult to remember, so it is important to store it in a safe place and in several copies, including on paper. With the help of a seed phrase, you can restore your cryptocurrency not only in the application you have chosen, but also in almost any other - even a phone breakdown and loss of access to the application does not threaten your money.

If you use a mobile wallet on a smartphone, it is worth additionally installing a pin code and access by FaceID / TouchID. In general, the more layers of protection, the better!

The best ways to make money on cryptocurrencies

The cryptocurrency market has become famous due to the incredible growth in the price of Bitcoin, but in fact there are a lot of different opportunities for earnings. Many of them are related to trading or investing, but also many options that do not require any investments.

Now I will briefly tell you about the most interesting, in my opinion, ways to earn income in cryptocurrency and from cryptocurrencies.

Method #1: Investing in Cryptocurrency

It would seem that cryptocurrency prices are already extremely high, but in fact, the potential for the growth of the crypto market is far from being exhausted. Over the past 5 years, it has grown 20 times and attracted a huge number of investors, thousands of startups and large businesses (Tesla, Microsoft, Visa, etc.). Even if the growth of Bitcoin stops, there are still dozens of promising crypto projects in which you can invest money.

I would not advise in principle to start investing with cryptocurrencies, but as part of the investment portfolio they have a place to be. There is no need to go far for reasons: when Bitcoin became popular in 2017, the return on investment in it was more than 1300%,which is incomparable with any traditional type of investment. True, after that, prices fell by 75%, but after a couple of years they rose again many times. Because of these swings, it is not worth keeping all the money in cryptocurrency, but keeping a small part of the investment portfolio in crypto is a good idea.

There are two main approaches to choosing investment cryptocurrencies:

- Buying Bitcoin. The idea: historically, it was BTC that grew the most, and it will definitely grow along with the emerging market, because it occupies half of it.

- Search for promising coins. Idea: the growth of the price of BTC has its limit, a lot of money has already been poured into it. But other cryptocurrencies are still developing and may even become the "bitcoin of the future".

Personally, I prefer the second approach, I make the main bet on Binance Coin, Ethereum and Solana. I like the first because it is connected with the largest crypto exchange Binance (where I also keep my coins), and the second because it is the second after bitcoin – an obvious candidate for a new market leader. Solana is an unequivocal leader among modern cryptocurrencies, its ecosystem is developing by leaps and bounds. I also keep a small stake in bitcoin, I think this is a mandatory moment for any crypto portfolio. At the moment, the results are as follows:

Method No2: Trading on a crypto exchange

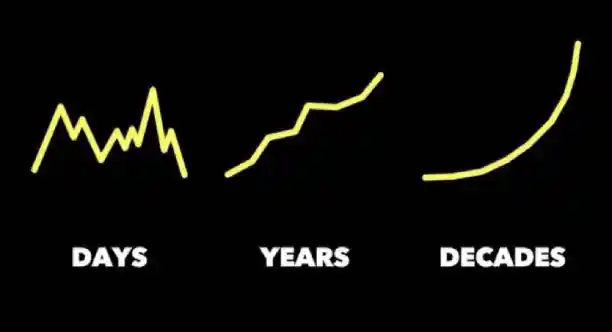

Unlike investing, where we buy cryptocurrencies for the long term, trading is the conclusion of transactions to buy and sell every day. Speculation can be very lucrative as coins are constantly changing in price. Compared to investing, this is riskier.

For successful trading, you need to be able to analyze price charts and indicators:

There are several types of transactions:

- Market — the current market price is set.

- Limit – you set a more favorable price for yourself and if the market reaches it, the deal will open.

- Stop – you set a less favorable price for yourself and if the market reaches it, the deal will open.

Example of a transaction:

-add here-

By clicking "Buy ETH", I change 0.056120 BTC to 0.0081 ETH. In the event that the ETH/BTC rate rises (ETH rises in price against BTC), for 0.0081 ETH I will receive more BTC and will be able to close the transaction with a profit.

When trading cryptocurrency, you can save a lot on commissions. Personally, I recommend starting on Binance – this is the largest and most reliable exchange. In addition, when you register through my affiliate link, you will receive 10% of trading commissions back:

It seems like a small thing, but if you make hundreds of trades, the bonus will become tangible.

Method No3: Copying transactions of crypto traders

A trader is a complex profession, and not everyone can succeed in it. Those who have already learned to trade profitably, investors are needed to increase earnings. So the idea of copying transactions appeared - the automatic transfer of transactions of an experienced trader to the trading account of a novice investor.

In cryptocurrencies, this opportunity appeared relatively recently. To copy transactions, you need to buy cryptocurrency on one of the exchanges, preferably on Binance because of its popularity. Next, select one of the copy trading services:

-add here-

Register and link the account with the exchange.

Next, you need to select a trader to copy. This is the most important point, because without a high-quality analysis, you can quickly lose all your money due to poor trading. My criteria are usually as follows:

- Trading history — from 3 years;

- The graph grows more or less smoothly;

- There are no large drawdowns;

- The Martingale strategy is not used;

- Small management fee.

The first crypto copying services began to appear quite recently, so there are simply no traders with a three-year history. Otherwise, there is a choice and you can choose for yourself a variety of strategies of any level of risk.

Method #4: Cryptocurrency Mining

For the successful operation of cryptocurrency with the Proof-of-work system, users with powerful computing equipment are needed to keep records of transactions and create new blocks in the blockchain. Such people are called miners, and the process itself is mining. For their work, miners receive a reward, for example, for bitcoin it is 6.25 BTC. Multiply by today's rate and understand that it looks very profitable!

True, the prize is received by only one network member every few minutes, and the higher the computing power, the higher the chance of becoming this lucky one. For such earnings, mining farms are created, which use ASICs (special computers for mining) and powerful video cards:

Have you ever heard of a shortage of computer graphics cards? Miners who actively use these devices for special "mining farms" for the production of cryptocurrencies are to blame for everything. Since 2017, when Bitcoin first became really popular, the war between miners and gamers does not end, which is reflected in the prices of video cards.

Due to the high competition, a single miner can sit for months without profit. To solve this problem, pools are created, in fact, a very large "farm". It combines the capacities of a large number of people, and the income is distributed depending on the calculations performed. Also, the pool takes a small commission, but all participants receive a more stable income.

There is an alternative way to passively earn money on maintaining the work of cryptocurrencies – staking.

Method #5: Cryptocurrency Staking

Mining is gradually becoming an environmental problem: bitcoin mining has already surpassed Argentina in terms of energy costs. This is also why new ways to manage the blockchain are being developed, and one of them is the use of the Proof-of-Stake system. It allows you to abandon mining, instead, the reward for maintaining the performance of the cryptocurrency is received by all its owners in the form of passive income. This is called staking.

The more coins are on the balance, the higher the chance of getting income in the form of new coins. The PoS algorithm does not use expensive equipment, so it is considered more environmentally friendly and energy-saving. However, to make a profit, it is necessary to temporarily freeze the currency in the account (similar to bank deposits).

It is most convenient to engage in staking on cryptocurrency exchanges. For example, Binance offers the following options:

Especially interesting for long-term investors is Ethereum staking, which appeared after one of the latest updates to the cryptocurrency – there is no particular risk in freezing the second most popular coin if you are counting on the long-term growth of the market. At the same time, the expected profit, although small, is still higher than with the usual purchase of ether.

Method #6: Cryptocurrency taps

Let's start with the easiest way to make money. Cryptocurrency faucets (English "faucet") are sites where you can get Bitcoin and other coins for free. You only need to perform a simple task: go to the site once every X minutes, click on the link, watch ads, take a survey and so on.

You can find dozens of similar sites, most of them are presented on the Faucetpay website - in the form of a rating by income and payout status. In my opinion, these cranes deserve attention:

The main way to make money on taps is to go to the site every 15-60 minutes and make a click, "pick up" coins. The income usually does not exceed a few satoshi (1/100000000 BTC), but if you use a lot of sites at the same time, the savings go faster. If you have time and desire, for additional earnings you can do additional tasks, such as:

In the first task you need to play the game, in the second to register on the site and perform tasks - it is quite realistic to perform, only there was time.

Immediately it is worth saying that thanks to the taps you will not become particularly richer, but still it is an interesting source of additional income. Its main advantage is that you get cryptocurrency for free, which in the future will certainly grow in price - and your income will increase several times over time.

Legality of cryptocurrencies in the countries of the world

Anonymous transfers around the world are convenient for both ordinary users and representatives of the criminal world. Because of this, bitcoin and other crypto began to be used in drug trafficking and other illegal business, which did not go unnoticed by governments around the world. And in general, the emergence of competition for the traditional monetary system has become a problem for those in power.

As a result, each country in the world has its own legal relations to cryptocurrencies:

On this map you see the status of Bitcoin in the countries of the world, but here are the numbers:

- Permitted or not explicitly illegal – 132 countries/territories (including most CIS countries);

- Limited — 8 countries, including China, Egypt, Morocco;

- Banned – 9 countries, including Algeria, Pakistan, Vietnam;

- Unknown - 108 countries/territories.

Interestingly, the classification of cryptocurrencies in the legal field has also become a problem. As a result, different countries came to different conclusions, here are the statistics:

- 55 countries (including Ukraine, Russia, Japan) are considered a currency;

- 23 countries (including China, Turkey, Belarus) are considered goods;

- consider money - 3 countries (British Virgin Islands, French Guiana, Libya);

- 10 countries (India, Australia, Argentina) are considered property;

- 4 countries (Austria, Canada, Germany, Philippines) are considered goods for barter;

- there is no classification – 18 countries (including Georgia, Portugal, UAE);

- 144 countries/territories are unknown.

The development of a legislative framework began quite recently, but the prospects for the recognition of cryptocurrencies look good. Bans are imposed mainly by Islamic countries, and only restrictions in China really greatly affect the crypto market.

Separately, it is worth mentioning El Salvador, a small country in Central America. It was there that on September 7, 2021, for the first time in the world, Bitcoin became the official currency of the country. El Salvador had many problems in the financial system, many residents simply did not have access to it. Now the owner of the smartphone can install the Chivo application and use the cryptocurrency for transfers:

A quarter of El Salvador's GDP is remittances from abroad, and now they should become easier and cheaper. The experiment is still creaking, but the precedent itself is important: there are many countries in the world where digital money is already used on a par with the official currency.

Industry Prospects in 2022

The crypto market continues to develop rapidly, and here are the trends worth paying attention to:

NFT or non-fungible token became the word of 2021 according to the British dictionary Collins English Dictionary, which once again proves how strong hype is in this area. If we abstract from the insane amounts that collectors pay for strange pictures and memes, the very technology of verification of digital content is extremely promising and can be used anywhere – up to the introduction of electronic passports on the blockchain. NFT projects and related cryptocurrencies will continue to be trending, especially given their need for NFT to work metaverses.

The metaverse is an Internet space where people can interact with digital objects and with each other through augmented (AR) and virtual (VR) reality technologies. This is a new trend, which was officially outlined by Mark Zuckerberg in October 2021, renaming Facebook to Meta to associate with the new product. More broadly, the metaverse is a collection of a huge number of virtual worlds, so the future decentralized financial system of the metaverse is in dire need of digital assets and cryptocurrencies.

DeFi or decentralized finance continues to gain momentum. Decentralized applications (DApps) for deposits and lending are increasingly competing with the traditional banking system. For this reason, regulators are seriously looking at them, but I doubt that you can greatly influence their work, because DApps were originally conceived independent of anyone. So this area will continue to grow.

GameFi or games with elements of earnings in cryptocurrency are becoming extremely popular, especially in countries with a low standard of living. With high prices of game coins, the income from games can compete with "ordinary" work. In fact, there is nothing new here – the market for in-game items/currencies has existed since the widespread use of the Internet and now it has embraced the cryptosphere.

State cryptocurrencies (CBDC). Every year, more and more countries join the race to implement them. The goal is clear – to lure users back to a centralized and controlled financial system. Such currencies will compete with bitcoin and companies, and in some countries it will be the only legal cryptocurrency. China was the fastest to orient itself: it has already declared war on independent cryptocurrencies and is introducing a digital yuan. In the US, they do not plan to ban crypto completely, but they want companies to report to the tax office about transactions. Each such news hits the capitalization of the crypto market, but in general, most countries of the world have a positive attitude to this area and are developing a legislative framework for its legalization.

It is difficult to say for sure whether 2022 will definitely be a successful year for the crypto market, it is too unpredictable. But if you look at 5-10 years ahead, then everything is obvious to me - the revolution in the financial sector has already come and is gaining momentum. I plan to allocate 10% of the portfolio to crypto investments and calmly observe what is happening.

Crypto Investor Dictionary

In this section, I have collected slang words and some terms that you will often come across in articles on cryptocurrencies:

Altcoin is any cryptocurrency that is not Bitcoin.

Bull/bear market – the state of the chart of the price of a cryptocurrency, when it steadily rises (bullish) or falls (bearish). The term came from the stock market. Why these animals: bulls are planted on horns and attack from the bottom up, bears loom their front paws and press from top to bottom. When the price does not rise and fall, it is called a sideways or flat.

X - an increase in investments in cryptocurrency by two (2 x, x2), three (3 x, x3) or more times.

Long/short is a buy transaction ("long") or sell ("short").

Keith is a major player in the cryptocurrency market, which with its transactions can significantly affect prices.

Pamp is the deliberate popularization of cryptocurrency and its purchase in large volumes in order to artificially disperse prices. The reverse term dump is the targeted sale of a large amount of crypto for a price collapse.

Native is from the English "to the moon" (to the moon), the expectation of multiple growth of the cryptocurrency. There is a reverse term.

FOMO is from the English "fear of missing out" or fear of missing out. In our case, it occurs when cryptocurrencies are actively growing and people are actively buying them, fearing to lose profits.

Hi, update high, new high – all this is about the historical maximum of the price of cryptocurrency.

Hodle is from the English "hold on for dear life", which can be translated as "to hold to the last". Denotes a strategy for investing in cryptocurrencies, in which the owner does not sell them for years in the expectation of a long-term price increase.

Hamster is an inexperienced investor who is poorly versed in cryptocurrencies and is highly susceptible to external influence.

Shitcoin - coin does not need translation. This word is called bad cryptocurrencies that do not carry practical value and are created only for the quick enrichment of owners.