15 min to read.

What is Tether USDT

What does Tether actually do? Is USDT a good investment? What is Tether crypto used for? Is tether realiable?

Table of Content

- Buy Tether (USDT) 2022 – Guide, Price & Forecast

- An overview of the most important USDT information

- What makes Tether a stable cryptocurrency? Why should you invest in it?

- What makes Tether unique?

- Tether buy fees

- Tether can be purchased via PayPal, credit card, instant transfer, and more

- Can tether be mined?

- What are the available tether wallets?

- Price forecast for the USDT (Tether)

- Is USDT worth buying?

- Are there any long-term benefits to investing in Tether?

- When is the best time to purchase Tether?

- How to Buy Tether (USDT)

- Tether advantages and disadvantages

- Tether FAQs

Buy Tether (USDT) 2022 – Guide, Price & Forecast

The majority of cryptocurrency prices are highly volatile, which means that they are not able to be stable over the long term. The use of stablecoins provides investors with a way to absorb the sometimes extreme fluctuations in the crypto market, to take a breath so to speak.

Tether (USDT) is quickly gaining in popularity just behind Bitcoin and Ethereum. Research has been conducted on the stable cryptocurrency and how investors can benefit from it.

The report also describes how and where to purchase Tether, gives detailed instructions for buying it, and provides a forecast of USDT's potential future development

Tether's founders intended to simplify transactions between different exchanges when they launched the stablecoin. The exchange rate of the digital currency reflects the value of the US dollar 1:1, and is set up on the principle of creating a stable cryptocurrency that can be used in the real economy in the same manner as major currencies.

Tether's stability makes it an excellent hedge against the natural fluctuations in the cryptocurrency market. The US dollar is linked to cryptocurrency, allowing crypto traders to secure fast transfers at low fees without the need to go through a central institution (such as a bank).

The ability to store other cryptocurrencies is yet another feature of the tether. If, for example, an individual wishes to sell Bitcoin or Ethereum within one year of purchasing them, he or she may be subject to taxes.

| network | tether |

| coins / tokens | USDT |

| company | Tether Limited |

| Tether Founder | Brock Pierce, Reeve Collins, and Craig Sellars |

| Founded | 07/09/2014 as real coin |

| rename | 11/20/2014 in Tether |

| maximum supply | unavailable |

| Current circulation supply | 62,280,355,385 USDT (as of 06/08/2021) |

| total supply | 64,471,767,617 USDT (as of 06/08/2021) |

An overview of the most important USDT information

- Market capitalization : currently over 51 billion euros market capitalization

- Market Rank : #3

- Current price : 0.822 euros (as of June 8th, 2021)

- Tether mirrors the value of the US dollar 1:1

- Most popular stablecoin

Using tether, investors do not need to worry about price losses when exchanging and storing their cryptocurrencies.

Tether is backed by 300 million US dollars in reserves. Tether is however backed by other assets in addition to USD, as it became known in 2019. Moreover, the company acknowledged that some of the collateral was provided by third-party loans, which are also used to secure Tether.

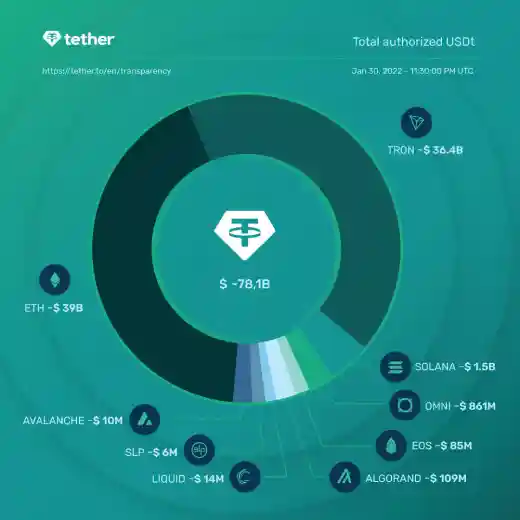

There are several blockchains integrated with Tether. Tether previously operated on the Bitcoin blockchain before switching to the Litecoin blockchain in 2017. Both blockchains use the Omni protocol. On top of that, Tether runs as an ERC-20 variant on Ethereum as well as Tron and Simple.

What makes Tether a stable cryptocurrency? Why should you invest in it?

Investors should think about their own trading strategy before making a decision to invest in a cryptocurrency. It is pointless to speculate on Tether since it aims to maintain the value of the dollar at 1:1. Stablecoin prices are not volatile and do not exhibit large price changes. In spite of this, there are several reasons to consider investing in stablecoins, and particularly in Tether:

- a dollar-pegged asset

- with low transaction fees

- could provide a tax advantage

- Stablecoin most widely used in the world

- Tether coins can be transferred to an external wallet or within the ecosystem for free

What makes Tether unique?

As a stablecoin linked to the dollar, Tether can show stable values. Other Tether derivatives have been developed, but they are based on other currencies, such as the euro, yuan, and gold. Investors can easily exchange fiat currencies for tether due to the less volatile and therefore stable prices. Both directions are exchanged at a 1:1 ratio. Investors receive exactly one tether for each US dollar.

In contrast with other cryptocurrencies, Tether is not an object of speculation but rather offers a relatively low-risk means of storing money and cryptocurrencies or parking them in markets experiencing negative interest rates and price collapses until the prices stabilize.

Tether buy fees

In addition to facilitating the transfer of cryptocurrencies, Tether also strives to keep costs low. A characteristic of the stablecoin is the low transaction fees and the free transfer to external wallets within the Tether ecosystem.</p>You should also take into account the fees associated with trading platforms when purchasing Tether. Currency conversion fees are minimal on Capital.com when trading USDT. There are no fees associated with Tether itself. It is also possible to deposit and withdraw money in euros without incurring additional fees.

The comparison of fees between the trading platforms is extremely important, since the higher the fees are estimated, the lower the income from profits obtaineYou may purchase Tether using PayPal, credit card, instant transfer, or other payment methods.

Tether can be purchased via PayPal, credit card, instant transfer, and more

Here is a list of the most popular payment methods for buying Tether:

PayPal

- Direct deposit and direct availability for trading

- provides comprehensive protection for buyers

- Bank details remain anonymous

- PayPal is also available for payments

Instant bank transfer

- Immediate availability of the trading amount on the account

- Transfer only possible with online banking access data and TAN

- Payment service provider Klarna

Credit card

- The deposited amount is immediately available on the trading account

- with a bank guarantee

- to protect your bank details

There are, of course, other methods by which funds can be deposited into trading accounts and used to purchase cryptocurrencies.

Can tether be mined?

Yes, cryptocurrency mining is possible. For that, you need hardware that uses enormous computing power. Mining consumes a lot of electricity. In regions with low electricity prices, mining new coins is the most worthwhile due to some low prices.

Tether mining is not a viable option for those who wish to mine the coin themselves. Each coin is issued exclusively by the company, which is also responsible for securing it. Tether has issued over 52 billion coins through April 2021. Since $1 must be set aside as collateral for each stablecoin generated, mining the stablecoin does not make sense. Mining would be impossible if reserves were controlled.

Tether is the sole issuer of the coin, which causes some critics to complain. Not least because of many negative headlines and rumors about the stablecoin's collateralization, the calls for a public audit are growing louder and louder.

What are the available tether wallets?

A person who purchases real coins or tokens must store them safely. In this regard, there are so-called wallets, which work like a money market account. The user must ensure that the wallet they choose is compatible with the coin or token they wish to use as well as how securely the coins should be stored.

- The highest level of security is provided by special hardware wallets and paper wallets. The “cold wallets” are not connected to the Internet and cannot be accessed by hackers.

- The situation is different with online wallets . Online wallets are also called hot wallets and are constantly connected to the internet or store the coins in the network. Resourceful hackers have the opportunity to illegally access the wallet at any time. Coins and tokens should not be stored in hot wallets over the long term.

- Hackers can easily target a desktop wallet as well, since it is one of the so-called hot wallets.

Several wallets are compatible with Tether, since it comes in so many forms. Numerous wallets, including those that support Bitcoin, are available for USDT based on Bitcoin. USDT is based on Ethereum and works with wallets that support ERC-20 tokens. The following wallets are available:

- Ledger Nano S

- Trezor

- MyEtherWallet

- trust wallet

You must pay attention to the functionality of the individual wallets if you intend to store different coins and tokens within the same wallet.

Price forecast for the USDT (Tether)

We can only observe that the price of the stablecoin nearly always reaches its target value as the price of the stablecoin develops. There should be one USDT per US dollar at all times. Even though the exchange rate varies from time to time, it remains worth 1 US dollar overall with a maximum deviation of 1 to 5 cents. As a result of negative headlines, the price collapsed to 90 cents per Tether coin on October 15, 2018. However, the course recovered quickly following the crash.

We consider the development steps and headlines that appear regularly to be more interesting, we call them milestones of the stablecoin:

- Under the former name, Tether was announced as a realcoin on July 9, 2014.

- Realwage is renamed to Tether on November 20, 2014 in order to avoid confusion with Bitcoin.

- A cyber attack on November 21 resulted in the theft of 31 million USDT from a wallet. Tether has responded by halting all trading immediately to launch an update that will hard-fork the stolen coins to invalidate them.

- Tether Limited announced in March 2019 that the coin is not solely backed by US dollars, but also uses other assets and loans from third parties.

- April 2019: The investigation by the New York prosecutor becomes public. Tether is alleged to have concealed over $850 million in losses.

Is USDT worth buying?

Crypto markets are subject to strong fluctuations, as any observer of the market knows. It makes sense to invest in USDT in times of decline. An investor can swap Bitcoin or Ethereum for USDT to convert back into other currencies once markets pick up instead of selling the volatile coins for fiat currencies. The value of tether is pegged to the US dollar, so "parking" cryptocurrencies in it doesn't entail much risk of loss.

Are there any long-term benefits to investing in Tether?

As a long-term store of value and a hedge against volatile cryptocurrencies, USDT seems suitable. For investors who want to keep their cryptocurrencies afloat while they wait for the market to calm down, Tether is a suitable tool. Losses caused by exchange rate fluctuations are rare with the US dollar due to its stability. We should still be alert, however.

The companies behind cryptocurrencies are new and nobody knows how secure they will be in the long run. It is impossible to rule out a total loss. Tether is, in our opinion, not suitable for short-term investment. Its price fluctuates insignificantly, making it difficult to generate profits.

When is the best time to purchase Tether?

Due to the fact that stablecoins like Tether are not subject to significant price fluctuations, the time to purchase Tether is always right. You should consider switching to volatile cryptocurrencies from your own portfolio when their price is declining. Our point of view is that buying Tether is a sensible alternative regardless of the possibility of negative interest rates on the financial markets. It would be advisable for stablecoin users to keep an eye on the market so as not to miss the optimal time to exchange their volatile currencies for Tether.

How to Buy Tether (USDT)

- Become thoroughly familiar with the coin and its collateralization

- Compare trading platforms

- Consider Tether as an investment or a store of value

- Select a wallet suitable for Tether

- Keep private keys and passwords for Stellar wallets safe and do not share them with anyone

- Asking yourself, “What do I want to achieve by buying Tether?”

How to buy tether

Estimated Cost

$0

Estimated Total Time

5 min

What is necessary:

ID Card

E Mail

Phone Number

Payment Method

Tool: A cryptocurrency market.

Compare Cryptocurrency Markets

Find an exchange that lists USDT in one or more cryptocurrency pairings. Then sign up with your email address and password. Compare exchanges when buying USDT to find the lowest fees and the latest exchange rates. Note: Many exchanges require your full name, contact information, and ID before allowing you to trade.

Create an account

To create an account with an exchange, you must verify your email address and identity. Have your photo ID and phone ready.

Make Payment

If your exchange supports Tether Coin, you can buy USDT directly with dollar, euro, pound or any other currency of your choice. Some exchanges charge commission fees that vary depending on the amount of USDT you buy, so be mindful of the cost of your transaction. Note: Some payment methods have higher fees and credit card payments are usually the most expensive.

tether buy

Select your chosen exchange to find the USDT match you want. Go to the markets section. Look at the buy USDT section and type in the amount of paired cryptocurrency you want to spend or the amount of USDT you want to buy. Note: Before completing the transaction, carefully review your transaction details, including the amount of Tether Coin you purchased and the total cost of the purchase.

Tether advantages and disadvantages

advantages

- pegged to the US dollar

- Static price, not volatile

- Low transaction fees

- Coin transfer to external wallet for free

Disadvantages

- Stablecoin does not lend itself to speculation

- Lots of negative reports

- Regional restrictions in use due to bans possible

Tether FAQs

What makes Tether unique?

Tether (USDT) is a stablecoin created in order to simplify transactions between different platforms and exchanges. Stablecoin pegged to the US dollar, aiming to be $1 per USDT

How has the price of Tether developed?

With a few exceptions, the target value of 1 US dollar has been consistently met. Only in 2018 did the USDT fall to 90 US cents for a short time, before quickly returning to the target price of 1 US dollar per Tether coin.

What is Tether's prediction?

It is a stablecoin that is not necessarily uncontested. The coin has received many negative headlines due to false information on its collateralization, investigations by public prosecutors, and a lack of transparency leaving plenty of room for speculation and rumors. Providing Tether manages to defy the rumours, then the signs are very good that the most widely used stablecoin will continue to grow.